Is Interest From Home Equity Loan Tax Deductible

Table of Content

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters.

Where To Deduct Your Interest Expense Form 1098, Form 1098, Mortgage Interest StatementForm 8396, Mortgage interest credit. Use the Offer in Compromise Pre-Qualifier to see if you can settle your tax debt for less than the full amount you owe. For more information on the Offer in Compromise program, go to IRS.gov/OIC. Go to IRS.gov/Payments for information on how to make a payment using any of the following options. Approve or reject authorization requests from tax professionals.

When is home equity loan interest not tax deductible?

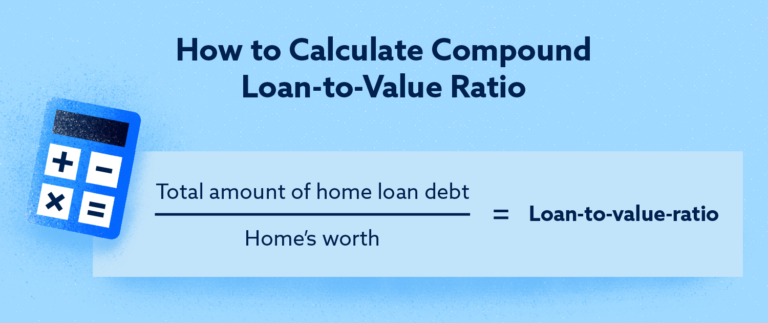

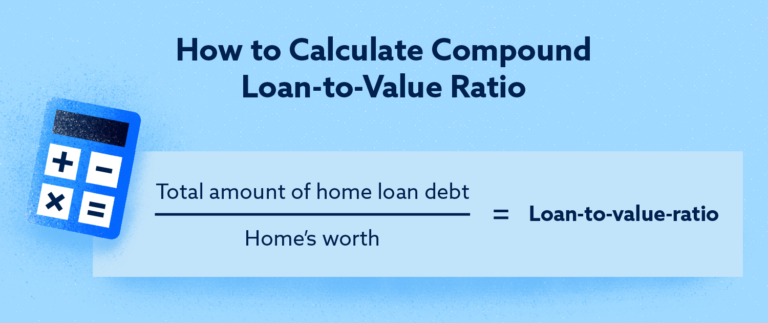

As a homeowner, you’re able to borrow up to a specified amount based on the combined loan-to-value ratio. That includes the outstanding balance from a first mortgage plus the additional requested funds. To take the home equity loan tax deduction, you must prepare your 1040s by providing the amount of interest paid on your loans. You borrowed $100,000 from your home’s equity and used the funds to pay for your child’s college education instead of taking student loans. You cannot take the tax deduction because you didn’t use the funds for a first or second home. This is because the funds used for debt consolidation aren’t eligible.

Learn how to file taxes for a deceased loved one with H&R Block. Small Business Small business tax prep File yourself or with a small business certified tax professional. If your home equity loan or HELOC is used to go snorkeling in Cancun or open an art gallery, then that’s home equity debt. However, if you’re using your home equity loan or HELOC to overhaul your kitchen or add a half-bath to your house, then it’s acquisition debt. For instance, if you borrowed against your home to pay for college, a wedding, vacation, budding business, or anything else, then that counts as home equity debt.

Are Home Equity Loans Tax Deductible?

Bill paid the points out of his private funds, rather than out of the proceeds of the new loan. The payment of points is an established practice in the area, and the points charged aren't more than the amount generally charged there. He made six payments on the loan in 2022 and is a cash basis taxpayer. If you are a homeowner who received assistance under the HAF, the payments from the HAF program are not considered income to you and you cannot take a deduction or credit for expenditures paid from the HAF program.

You can take the deduction based on a percentage of how much of your home is used for business, or based on a flat $5-per-square-foot rate for up to 300 square feet. You can use Schedule LEP, Request for Change in Language Preference, to state a preference to receive notices, letters, or other written communications from the IRS in an alternative language, when these are available. Once your Schedule LEP is processed, the IRS will determine your translation needs and provide you translations when available. If you have a disability requiring notices in an accessible format, see Form 9000.

Easily Save Clients Thousands in Taxes

The mortgage statement you receive from the lender includes total interest of $5,100 ($4,480 + $620). You can deduct the $5,100 if you itemize your deductions. Many monthly house payments include an amount placed in escrow for real estate taxes.

You can only deduct interest payments on principal loans of up to $750,000 if married but filing jointly and $375,000 if youre filing independently if you bought a home after December 15th, 2017. Starting with your 2018 return, you can no longer deduct more than $10,000 for state and local property taxes combined, or $5,000 if you are married but filing separately. Adding new sidingThis gives you a general idea of all of those home improvement projects that are still tax-deductible.

How To Figure Federal Income Tax On Paycheck

You may be able to take a credit if you made energy saving improvements to your home located in the United States in 2021. See the Instructions for Form 5695, Residential Energy Credits, for more information. Limit for loan proceeds not used to buy, build, or substantially improve your home.

Usually, you can deduct the entire part of your payment that is for mortgage interest if you itemize your deductions on Schedule A . See Limits on home mortgage interest next for more information. Generally, the corporation will tell you your share of its real estate tax. This is the amount you can deduct if it reasonably reflects the cost of real estate taxes for your dwelling unit.

Home equity loans generally carry lower interest rates than other loans, such as unsecured personal loans, but may involve higher fees and other costs. And they are only available to homeowners who have enough equity in their homes to meet lenders loan-to-value requirements. LTV benchmarks typically limit loans to 80%A fin of the homes appraised value. Interest on home equity loans has traditionally been fully tax-deductible. But with the tax reform brought on by President Trumps Tax Cuts and Jobs Act , a lot of homeowners are struggling to work out whether they can still take a home equity loan tax deduction. Interest on home equity debt is tax deductible if you use the funds for renovations to your homethe phrase is buy, build, or substantially improve.

For example, you can deduct the interest if you use the proceeds to build an addition onto your home, renovate your kitchen, or replace your roof. For 2021, you can deduct the interest paid on home equity proceeds used only to buy, build or substantially improve a taxpayers home that secures the loan, the IRS says. The deduction applies to interest paid on home equity loans, mortgages, mortgage refinancing, and home equity lines of credit.

Find out more about this deduction and how you can benefit from it. Home equity loans and HELOCs can be a quick and easy way to access a large sum of money to pay for major expenses. Home equity loans use equity in the borrowers home as collateral. Taking out a home equity loan therefore means putting the borrowers home at risk. If the borrower fails to pay back the loan, the lender can foreclose and sell the home to pay off the debt. Getting a HELOC when one is available also makes more cash accessible in an emergency.

With TurboTax Live Full Service Deluxe, a tax expert will do your taxes for you and find every dollar you deserve. You can also file taxes on your own with TurboTax Deluxe. We’ll search over 350 deductions and credits so you don’t miss a thing. It's likely that your mortgage lender has a security interest in your home as collateral for repayment of the loan. This security interest generally allows the bank to remain on the title to your home.

Comments

Post a Comment